In the age of electronic digital business banking, we quite often forget about the significance of the traditional teller home window. The teller home window is the central element of consumer banking that permits buyers to execute dealings quickly and efficiently. The teller home window helps to ensure that buyers acquire great-high quality customer support, as well as their economic cashier’s tray requires are met quickly. In this article, we are going to check out the key benefits of the teller window and its particular efficiency in consumer banking professional services.

Individualized Customer Care:

One of several important features of the teller windowpane is it offers personalized customer care. Buyers can connect with a teller face-to-face and inquire queries and explain their worries as opposed to depending on chatbot guidance. Teller home windows assist customers really feel protect knowing that another person is managing their economic transactions, as opposed to feeling like they may be doing the purchases by itself. The teller home window can endear customers on the consumer banking sector and think that they are component of a neighborhood.

Velocity and Productivity:

The teller home window can also be extremely fast and productive. Teller microsoft windows really are a existence-saver during speed hour or so and getaways when Cash machine line is very long. Most banks have numerous teller windows available during the day, allowing for a lot fewer wait periods and swift purchases. A seasoned teller can complete a financial purchase with wonderful speed, making sure customers are not waiting in extended lines. The teller windows is the most sensible thing for consumers that need a brief economic financial transaction.

Flexibility:

Due to the mobility of the teller home window, it might provide much more than just deposit and drawback features. Some tellers are specialists in distinct services like foreign exchange swap, bank loan queries, and a lot more. This benefit-included service makes sure that clients receive their banking needs fulfilled on the more personalized and customized degree.

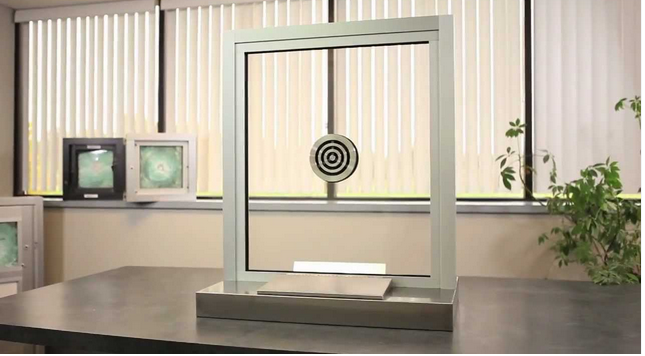

Authorization and Security:

Security is important in business banking, and teller house windows present an included level of protection that buyers can count on. Financial institutions ordinarily have high-high quality safety precautions set up and skilled tellers that can swiftly recognize fake activities. Teller house windows provide harmless methods for customers when they would like to take away or deposit huge amounts of money.

Stimulates Saving Practices:

The teller window facilitates the cost savings practice in customers by marketing modest price savings banks. Some banking companies have preserving accounts for young children that promote protecting habits, and financial institutions make use of the teller window to teach buyers on financial savings and financial. The teller windows not simply supplies financial suggestions but can also help clients set up fiscal literacy that might be beneficial in the end.

Simply speaking:

The teller home window continues to be just about the most vital areas of banking. It enables custom made customer satisfaction, velocity, effectiveness, overall flexibility, authentication, protection, and savings routines to clients. Whilst on-line consumer banking is rapidly increasing, the teller window remains to be essential for those who search for the ideal monetary deals and individualized customer support. The teller window is not only a method of performing financial institution deals, however it works as a respected buyer encounter that may be crucial in today’s business banking case.